1-Step FUNDED TRADER PROGRAM

UNLIMITED TIME 1-STEP FUNDING

Dive into a funded trader program that’s all about giving you space and time, with a generous drawdown and no daily drawdown. It’s your trading journey, on your terms – let’s make it amazing together!

1-STEP FUNDED ACCOUNT PLANS

CHOOSE YOUR ACCOUNT SIZE

-

$80,000

-

$60,000

-

$40,000

-

$20,000

-

$10,000

-

$4,000

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $80,000 |

| Evaluation | $20,000 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $999 | - |

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $60,000 |

| Evaluation | $15,000 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $749 | - |

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $40,000 |

| Evaluation | $10,000 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $499 | - |

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $20,000 |

| Evaluation | $5,000 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $299 | - |

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $10,000 |

| Evaluation | $2,500 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $149 | - |

| Phase 1 | Funded | |

|---|---|---|

| Funded | - | $4,000 |

| Evaluation | $1,000 | - |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | - | - |

| Profit Target | 10% | Scaling Plans* |

| Profit Share | 50% | Up to 100% |

| Max Daily Drawdown | - | - |

| Max Absolute Drawdown | 6% | 6% |

| Max Trailing Drawdown | - | - |

| Drawdown Type | Balance Based | Balance Based |

| Monthly Salary | - | Up to $500/Month |

| Leverage | Up to 1:10 | Up to 1:33 |

| One-Time Fee | $59 | - |

VARIETY OF SYMBOLS

Trade a wide variety of assets, including Forex, Indices, Commodities, and Crypto.

Weekend / Overnight

Hold your trades over the weekend or overnight. Low swap fees perfect for swing traders.

News Trading

Feel free to trade the news according to your strategy without any restrictions.

All Trading Styles

Whether you prefer using EAs, hedging, or discretionary trading, there are no limits or restrictions.

EXPONENTIAL SCALING PLANS

Hit a 10% profit target, and we’ll double your account, offering to scale up to $2,000,000 per account. With our exponential growth funded accounts, you can take your trading career to new heights, fast!

-

$80,000

-

$60,000

-

$40,000

-

$20,000

-

$10,000

-

$4,000

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $20,000 | $2,000 | 50% | $1,000 |

| PM LV1 | $80,000 | $8,000 | 60% | $4,800 |

| PM LV2 | $160,000 | $16,000 | 70% | $11,200 |

| PM LV3 | $320,000 | $32,000 | 80% | $25,600 |

| PM LV4 | $640,000 | $64,000 | 80% | $51,200 |

| PM LV5 | $1,000,000 | $100,000 | 90% | $90,000 |

| PM LV6 | $2,000,000 | Unlimited | 100% | Unlimited |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $15,000 | $1,500 | 50% | $750 |

| PM LV1 | $60,000 | $6,000 | 60% | $3,600 |

| PM LV2 | $120,000 | $12,000 | 70% | $8,400 |

| PM LV3 | $240,000 | $24,000 | 80% | $19,200 |

| PM LV4 | $480,000 | $48,000 | 80% | $38,400 |

| PM LV5 | $1,000,000 | $100,000 | 90% | $90,000 |

| PM LV6 | $2,000,000 | Unlimited | 100% | Unlimited |

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $10,000 | $1,000 | 50% | $500 |

| PM LV1 | $40,000 | $4,000 | 60% | $2,400 |

Continue on the PM LV1 $80K Account

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $5,000 | $500 | 50% | $250 |

| PM LV1 | $20,000 | $2,000 | 60% | $1,200 |

Continue on the PM LV1 $40K Account

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $2,500 | $250 | 50% | $125 |

| PM LV1 | $10,000 | $1,000 | 60% | $600 |

Continue on the PM LV1 $20K Account

| LEVEL | ACCOUNT SIZE | PROFIT TARGET | PROFIT SHARE | YOU GET |

|---|---|---|---|---|

| Evaluation | $1,000 | $100 | 50% | $50 |

| PM LV1 | $4,000 | $400 | 60% | $240 |

| PM LV2 | $8,000 | $800 | 70% | $560 |

| PM LV3 | $16,000 | $1,600 | 80% | $1,250 |

| PM LV4 | $32,000 | $3,200 | 80% | $2,550 |

| PM LV5 | $64,000 | $6,400 | 80% | $5,100 |

| PM LV6 | $128,000 | $12,800 | 80% | $10,200 |

| PM LV7 | $256,000 | $25,600 | 80% | $20,450 |

| PM LV8 | $512,000 | $51,200 | 80% | $40,950 |

| PM LV9 | $1,000,000 | $100,000 | 90% | $90,000 |

| PM LV10 | $2,000,000 | Unlimited | 100% | Unlimited |

HOW THE 1-STEP PROGRAM WORKS

PHASE 1

Choose an account size that fits your goals to become a funded trader. We offer various account sizes to cater to all traders worldwide.

FUNDED TRADER

Receive x4 of the instant funded account's starting balance. Enjoy the simplicity and flexibility of trading without any complex rules holding you back.

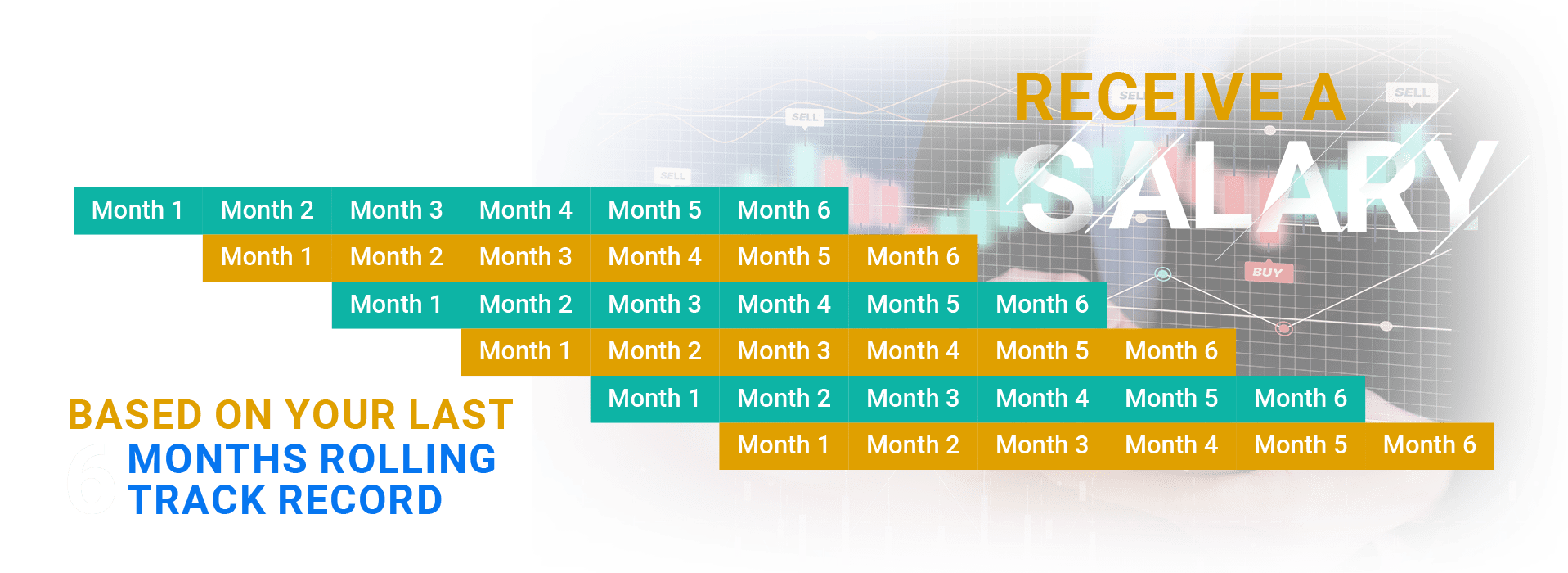

Monthly Salary

At CTI, we’re taking trader rewards to the next level!

We understand the effort and expertise you put into your trades, and that’s why we are thrilled to introduce our monthly salary for our dedicated CTI traders.

Even if you begin with smaller plans, there’s ample room for growth. As you climb through our scaling plans, your salary isn’t static – it grows with you.

WHAT OUR FUNDED TRADERS SAID

Read our 1,200+ reviews at Trustpilot, Google, & YouTube Success Stories.